CRA My Account is an online portal to manage your taxes and benefits. To register, go to the CRA website, sign in with a CRA ID or online banking, and verify your identity. A mailed security code gives full access.

Have you registered for your CRA My Account yet? All Canadians have access to this secure online portal, which offers numerous benefits when utilized effectively.

While the registration process might seem daunting, it doesn't have to be. With the right information and guidance, you can easily set up and start using your CRA My Account.

If you're wondering, "Where do I start with my CRA account?"—this guide is for you. We'll walk you through the essentials of setting up your personal CRA account, including the dos and don'ts of the registration process and the necessary documentation to ensure a smooth experience.

What Is the CRA My Account?

The CRA My Account is a secure online portal provided by the Canada Revenue Agency (CRA). It allows individuals to access and manage their personal income tax and benefit information online.

Through this portal, you can:

- View your income tax returns and notices of assessment

- Check your Registered Retirement Savings Plan (RRSP) and Tax-Free Savings Account (TFSA) contribution limits

- Track your benefit and credit payments, such as the Canada Child Benefit (CCB) and GST/HST credits

- Set up direct deposit for faster payments

- Submit documents and correspond with the CRA securely

Accessing your CRA My Account requires registration, which involves obtaining a CRA user ID and password or using a Sign-In Partner.

Benefits of Having a CRA My Account

Having a CRA My Account offers numerous advantages:

1. Convenient Access to Tax Information

No more waiting on hold to speak with a CRA representative. With your online account, you can:

- View and print your tax returns and notices of assessment

- Check your RRSP and TFSA contribution limits

- Monitor your Home Buyers' Plan and Lifelong Learning Plan balances and repayment schedules

- Track unused amounts from tuition, education, and textbook credits

2. Manage Benefit and Credit Payments

Easily access information about your:

You can view payment dates, amounts, and update your direct deposit information to ensure timely receipt of funds.

3. Streamlined Communication with the CRA

Use your account to:

- Submit documents electronically

- Receive and respond to CRA correspondence securely

- Update personal information, including your address, marital status, and direct deposit details

4. Simplify Financial Transactions

Set up pre-authorized debit agreements to pay your tax balances in installments, making it easier to manage your financial obligations.

5. Access Important Documents

Need an Option C printout for mortgage applications or other financial needs? You can download it directly from your CRA My Account without the need to call the CRA.

CRA Account: What You Can Access From It

1. CRA My Account (Individual)

After signing into your CRA My Account, you gain access to a wide range of services designed to manage your personal tax and benefit information. Here's what you can do:

- View Your Tax Information: You can access your past and current tax returns, as well as your Notice of Assessment. These documents provide key information about your tax situation, including any tax refunds or amounts owing.

- Apply for Benefits: You can apply for various federal and provincial benefits, such as the Canada Child Benefit (CCB), GST/HST credits, and other family-related benefits. You can also check the status of your existing benefit applications.

- Manage Payments: From your CRA My Account, you can make payments for any outstanding tax amounts. This includes the ability to set up pre-authorized debit arrangements for paying your taxes in installments. Furthermore, you can track the payment history for both your tax balances and benefits.

- Update Personal Information: You can update your personal details, such as your mailing address, marital status, and direct deposit information. This ensures your CRA records are always current, helping prevent delays in benefit payments or tax assessments.

- Request Documents: You can order documents like Option C prints (for mortgage applications) directly from your account, reducing the need for calls to the CRA.

For further details on what you can access, visit the About My Account page.

2. CRA My Business Account

If you run a business, My Business Account allows you to manage your business taxes and filings with the CRA. Here's what you can do with this account:

- File and Submit Returns: Through My Business Account, you can file GST/HST returns, corporate tax returns, and other business-related tax documents. This includes submitting T4 slips, T5 slips, and business income tax returns.

- View Business Information: You can view your business's tax obligations and track filing deadlines. The portal also allows you to monitor any tax credits your business is eligible for, such as research and development credits.

- Update Business Details: You can update essential business information, such as business address, contact information, or banking details. Keeping this information current ensures your business doesn't miss out on important communications from the CRA.

- Make Payments: You can make tax payments and view your payment history. This includes options for e-transfers or pre-authorized debits. Making sure that your business remains compliant with CRA obligations is easier with this tool.

- Access Notices and Assessments: You can view all CRA correspondence, such as notices of assessments or reassessments, directly from your My Business Account. This allows you to stay informed about any changes to your tax liabilities.

To learn more, check the About My Business Account page.

3. Represent a Client

If you’re an accountant, lawyer, or any other authorized representative, the Represent a Client service allows you to manage someone else's tax and business information. This service is particularly useful if you need to represent a family member, friend, or client. Here’s how it works:

- View and Manage Tax Information: You can access a client’s tax records, view their notices of assessment, and track the status of their benefits and filings. This feature is ideal for accountants managing multiple clients' taxes or legal representatives working with clients on tax matters.

- File and Submit Returns: You can file tax returns on behalf of your clients. This includes everything from individual tax returns to business tax filings. You’ll also have access to programs such as HST/GST filings and the Canada Pension Plan contributions.

- Submit Documents: You can upload or submit documents to the CRA on behalf of your client, such as supporting documents for tax claims or additional information requested by the CRA.

- Authorization: To use this service, you need the explicit authorization of the individual or business you’re representing. This can be done by submitting the T1013 form or via the Represent a Client online form, which gives you the necessary permissions to manage their tax affairs.

- Request Correspondence: As a representative, you can also receive CRA correspondence regarding your client's account and respond on their behalf, reducing the burden on the client to manage tax-related matters.

For more detailed information, visit the About Represent a Client page.

These tools in CRA’s suite of online accounts provide a secure, efficient way to manage personal and business taxes, apply for benefits, and represent clients with authorization. Each account serves a distinct purpose, ensuring both individuals and businesses can interact seamlessly with the CRA.

How to Register for a CRA Account

Whether you’re an individual managing your personal taxes, a business owner handling business taxes, or a representative assisting clients, registering for a CRA account is a crucial step. By registering, you’ll gain access to My Account, My Business Account, and Represent a Client to easily manage your tax and benefit information online.

1. Register for My Account (For Individuals)

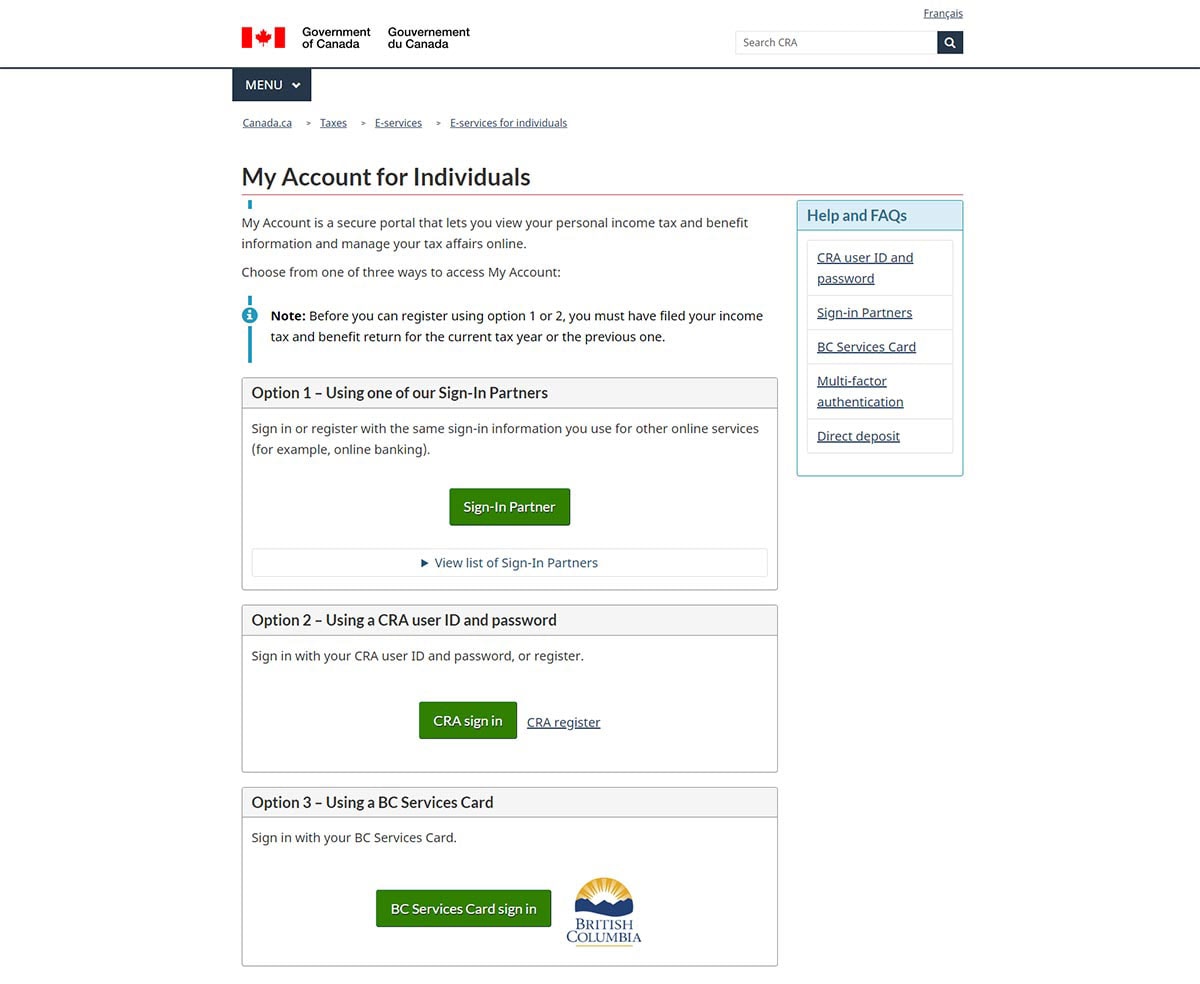

My Account for individual allow users to manage their personal tax and benefit information. To register for My Account, follow these steps:

- Step 1: Visit the CRA My Account registration page.

- Step 2: Choose a registration method. You can either use a CRA user ID and password or sign in through a Sign-In Partner (your online banking credentials with participating financial institutions).

- Step 3: Enter your personal information, including:

- Your Social Insurance Number (SIN)

- Date of birth

- Postal code

- A line amount from your most recent tax return (this is used to verify your identity).

- Step 4: After completing the registration, CRA will send you a security code by mail. Once you receive this, log in to your account and enter the code to gain full access.

Important Tip: Make sure your address is up to date with the CRA before registering to avoid delays in receiving your security code.

2. Register for My Business Account (For Business Owners)

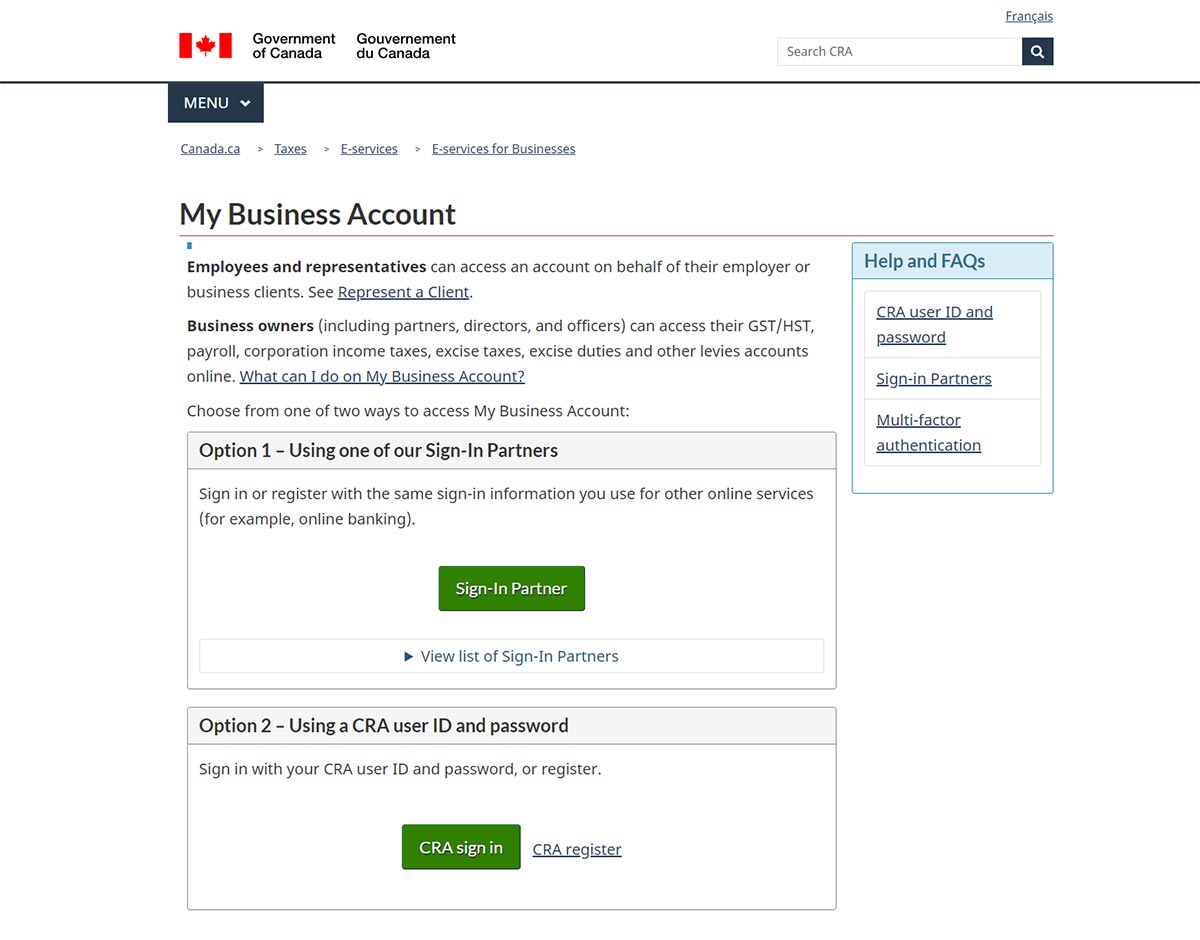

My Business Account is designed for business owners to manage their business tax information with the CRA. To register for My Business Account, follow these steps:

- Step 1: Visit the CRA My Business Account registration page.

- Step 2: Choose your preferred registration method. You can register using a CRA user ID and password or through a Sign-In Partner.

- Step 3: Enter your business details, including your Business Number (BN), legal name, and postal code. For authentication, you'll need to provide information from a recent tax return or your GST/HST filings.

- Step 4: CRA will send a security code to your registered address. Enter this code once received to complete your registration and access your business account.

Tip for Businesses: Keep your business’s tax information (like GST/HST number) readily available during registration to ensure a smooth process.

3. Register for Represent a Client (For Tax Representatives)

If you are an accountant, lawyer, or another authorized representative, Represent a Client allows you to manage someone else’s tax and benefit information on their behalf. Here's how to register:

- Step 1: Visit the Represent a Client registration page.

- Step 2: Log in using either your CRA user ID and password or Sign-In Partner credentials.

- Step 3: You’ll need to submit authorization for each client or business you wish to represent. This can be done by filling out the T1013 form or using the Represent a Client online form to grant you access.

- Step 4: Once authorized, you can access your client’s tax records, file returns on their behalf, and submit necessary documents to the CRA.

Important Note: Always ensure you have proper authorization from the client to access and manage their information. Without it, you won’t be able to proceed with the registration.

What You’ll Need to Register

Regardless of the account type, here’s a general checklist of what you’ll need:

- Personal Information: For individuals, your SIN, date of birth, and address.

- Tax Documents: For verification, you may need information from recent tax returns (e.g., a line from your Notice of Assessment).

- Security Code: Once you complete your registration, a CRA security code will be mailed to your address. You’ll need this to complete your setup.

- Business Information (if applicable): For business owners, have your Business Number (BN) and other business tax details.

After You Register: What to Expect

Once registered, you’ll have ongoing access to your CRA My Account, My Business Account, or Represent a Client portal. Here’s what to do after registration:

- Log in: Use your CRA user ID and password, or your Sign-In Partner credentials, to access your account.

- Verify Your Information: Once logged in, review your personal or business details and ensure everything is correct.

- Access Services: You can view your tax returns, manage payments, apply for benefits, track benefit payments, and more.

FAQs About CRA My Account

If you're new to the CRA My Account or have been using it for years, you're not alone in having questions. From registration issues to accessing benefits, Canadians often search for answers online. Below are the top frequently asked questions with concise answers to help you navigate the CRA My Account confidently and efficiently.

The CRA My Account is used to manage your personal tax and benefit information online. It gives you access to your Notice of Assessment, tax return status, RRSP and TFSA contribution limits, direct deposit settings, and much more. It's the fastest and most convenient way to interact with the CRA.

No, they are different. CRA My Account is managed by the Canada Revenue Agency and deals with taxes and benefits, while My Service Canada Account is operated by Service Canada and handles Employment Insurance (EI), Canada Pension Plan (CPP), and Old Age Security (OAS). You can link both accounts for easier access.

To reset your CRA password, visit the CRA login page and click on “Forgot your password?”. You'll need to verify your identity using your security questions or registration information. If you're locked out, you may need to contact CRA directly.

Typically, it takes 5 to 10 business days for the CRA security code to arrive by mail. However, mailing times may vary based on your location and the time of year. Without the code, you’ll only have limited access to your account.

Yes, you can create an account and access basic features, but full access is restricted until you enter the security code mailed to you. This includes viewing detailed tax information and managing your benefits.

Using My CRA Account to the Fullest

Now you know all of the facts and features about My CRA Account. This account can be an invaluable tool for both businesses and individuals. You can stay stress-free by keeping all of your tax and banking information organized in one place.

You can even get quick access to necessary government forms. For more information on how to register for My CRA Account, or use its benefits, contact the Insurdinary team today.