To access your My Service Canada Account (MSCA), go to the official MSCA login page and sign in using one of three options: your GCKey, your Sign-In Partner (such as your bank), or your Provincial Digital ID (available in select provinces). Once logged in, you can securely view and manage your benefits, applications, and personal…

If you're a Canadian citizen, permanent resident, or temporary worker accessing federal benefits like Employment Insurance (EI), the Canada Pension Plan (CPP), or Old Age Security (OAS), then having a My Service Canada Account (MSCA) is essential. This online portal simplifies how you apply for, manage, and receive payments for many government services — all in one convenient place.

In this updated and comprehensive 2025 guide, we’ll walk you through everything you need to know about MSCA: what it is, how to register and log in, what benefits you can access, how to resolve common issues, and tips for getting the most out of your account.

Disclaimer:

All, or some of the products featured on this page are from our affiliated partners who may compensate us for actions and or sales completed as a result of the user navigating the links or images within the content. How we present the information may be influenced by that, but it in no way impacts the quality and accuracy of the research we have conducted at the time we published the article. Users may choose to visit the actual company website for more information.

What Is My Service Canada Account?

MSCA is a secure, personalized online service platform offered by Employment and Social Development Canada (ESDC). It allows individuals to access and manage a range of federal benefits and programs without visiting a Service Canada Centre in person.

What You Can Do with MSCA:

- Apply for and manage Employment Insurance (EI) claims

- Check your contributions and apply for Canada Pension Plan (CPP) or CPP Disability

- Apply for Old Age Security (OAS) and Guaranteed Income Supplement (GIS)

- Track your Canada Apprentice Loan

- View and download your tax slips (T4E, T4A(P), T4A(OAS))

- Access your Social Insurance Number (SIN) info

- Update direct deposit and mailing information

- Upload supporting documents

- Access the Canadian Dental Care Plan (CDCP)

Everything is centralized in one easy-to-navigate dashboard that reflects the newest features and layouts implemented in 2025. Keep reading to learn more about MSCA.

Once you're logged into your My Service Canada Account, you'll gain access to a wide range of federal benefits and tools designed to help you manage your finances, employment history, and retirement planning. Below is a detailed look at the key services available through MSCA, along with what you can do in each section.

Employment Insurance (EI)

Whether you've recently lost your job or need time off due to sickness, maternity, or caregiving responsibilities, MSCA makes it easy to apply for and manage your Employment Insurance (EI) benefits. The platform offers step-by-step guidance and real-time updates to keep your claim on track.

- Apply online for regular or special EI benefits (maternity, sickness, caregiving).

- Submit biweekly reports to maintain eligibility.

- View claim status, payment dates, and amounts.

- Get updates on employer-submitted Records of Employment (ROEs).

- Easily edit direct deposit info or personal details.

In 2025, EI processing times are faster, and status changes (approval, pending, denied) appear in real-time.

Canada Pension Plan (CPP) & CPP Disability (CPP-D)

Planning for retirement or facing a disability? MSCA provides a secure way to apply for and manage your CPP or CPP Disability benefits. You can track your contributions, understand your entitlements, and stay informed about your application’s status — all in one place.

- Apply for CPP Retirement, Disability, or Survivor benefits.

- Review your Statement of Contributions, showing how much you’ve contributed and what you’re eligible to receive.

- Access payment summaries for tax and income reporting.

- Notify of life events like marriage, divorce, or death of a spouse (for survivor benefits).

Now includes digital signature uploads, eliminating the need for mail-in forms.

Old Age Security (OAS) and Guaranteed Income Supplement (GIS)

If you're turning 65 or have a low income in retirement, you can use MSCA to apply for Old Age Security and the Guaranteed Income Supplement. The portal allows you to monitor applications, manage payment details, and receive notifications on your eligibility and approval.

- Apply or check eligibility for OAS at age 65 or GIS if your income is low.

- Track application progress and get notified when decisions are made.

- View past and future payment dates, and download statements for tax or visa purposes.

Canadian Dental Care Plan (CDCP)

New in 2025, the Canadian Dental Care Plan (CDCP) is now fully integrated into MSCA, making it easier to manage dental coverage directly from your account. This is especially helpful for families and seniors who need to track claims or update dependent details.

- View your eligibility, enrolled dental providers, and coverage information.

- Submit or track dental service receipts and claims.

- Update dependent info for family-based plans.

Canada Apprentice Loan

If you’re in a registered apprenticeship program, you can use MSCA to manage your Canada Apprentice Loan. From applying for funding to adjusting repayment terms, everything can be handled digitally, giving you more time to focus on your training.

- Apply for funding while completing apprenticeship training.

- Monitor disbursements and outstanding balances.

- Set up or adjust repayment terms.

- Access loan forgiveness options if you meet eligibility.

Accessing Tax Slips and Employment Records

MSCA also serves as a central location to access important tax documents and employment records. These are often needed for tax filing, income verification, or loan applications — and are available to download anytime.

- View and download:

- T4E (Employment Insurance)

- T4A(P) (CPP)

- T4A(OAS)

- Review Statements of Benefits to confirm income received.

- Get income verification letters for CRA, landlords, or loan applications.

New Users: How to Register for a My Service Canada Account

Creating an MSCA is easier than ever, especially with the streamlined sign-in and identity verification methods available in 2025.

Step 1: Gather Required Information

Before starting your registration, prepare the following:

- Social Insurance Number (SIN) – Required for identity verification.

- Date of birth

- Mother’s maiden name – Used as a secondary identifier.

- Current postal code

- Access to your bank’s online credentials, a GCKey, or a provincial ID account

Step 2: Choose a Sign-In Method

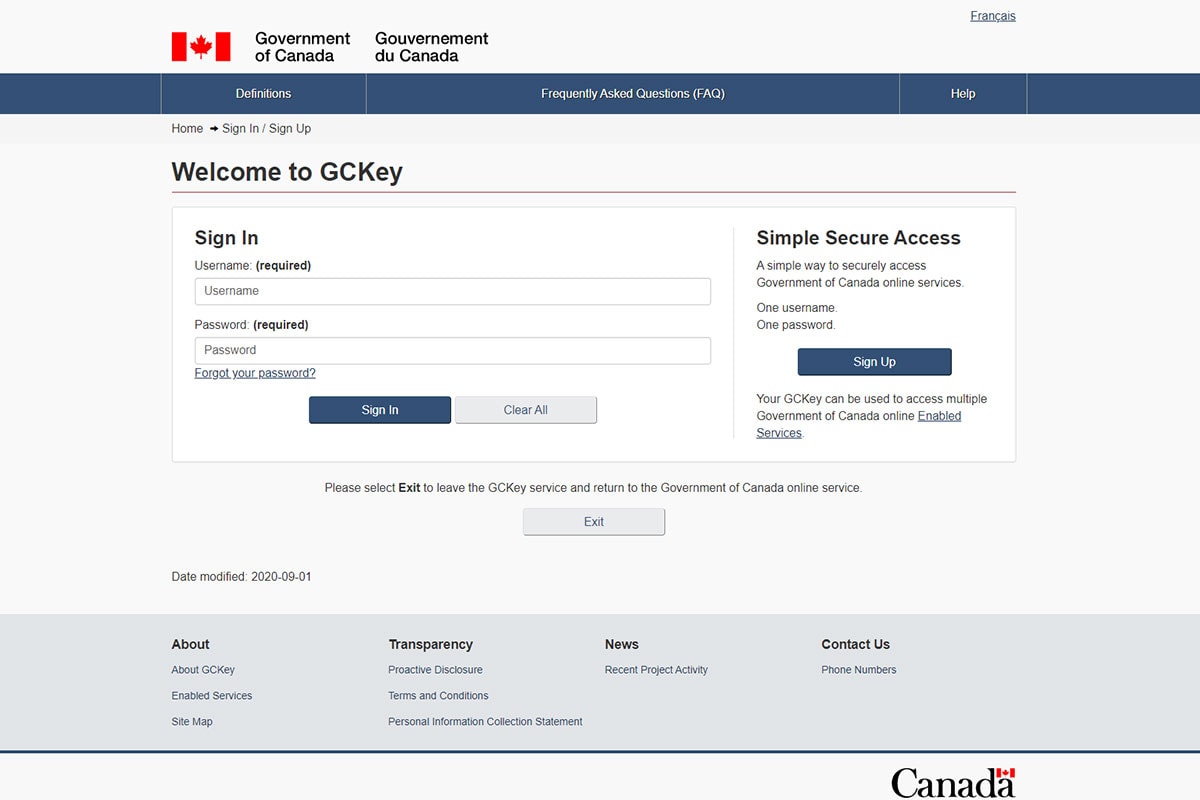

Option 1: Register with the GCKey

The GC Key is an electronic credential that’s unique that the Canadian government issues. To log in using it, you must have a PAC (Personal Access Code) and a GC Key ID. To get started, you first have to request an access code. To do this you’ll need:

- If you’re a Canadian resident, your postal code

- If you’re a foreign resident, your residence country

- Your parent’s family name when you were born

- Your SIN (Social Insurance Number)

It will take between 5 and 10 business days for you to receive it by mail. Once you’ve received it, you have to sign up for your GC Key. This will include your username and a password. Finally, you can register for MSCA with your access code, GC Key, and SIN.

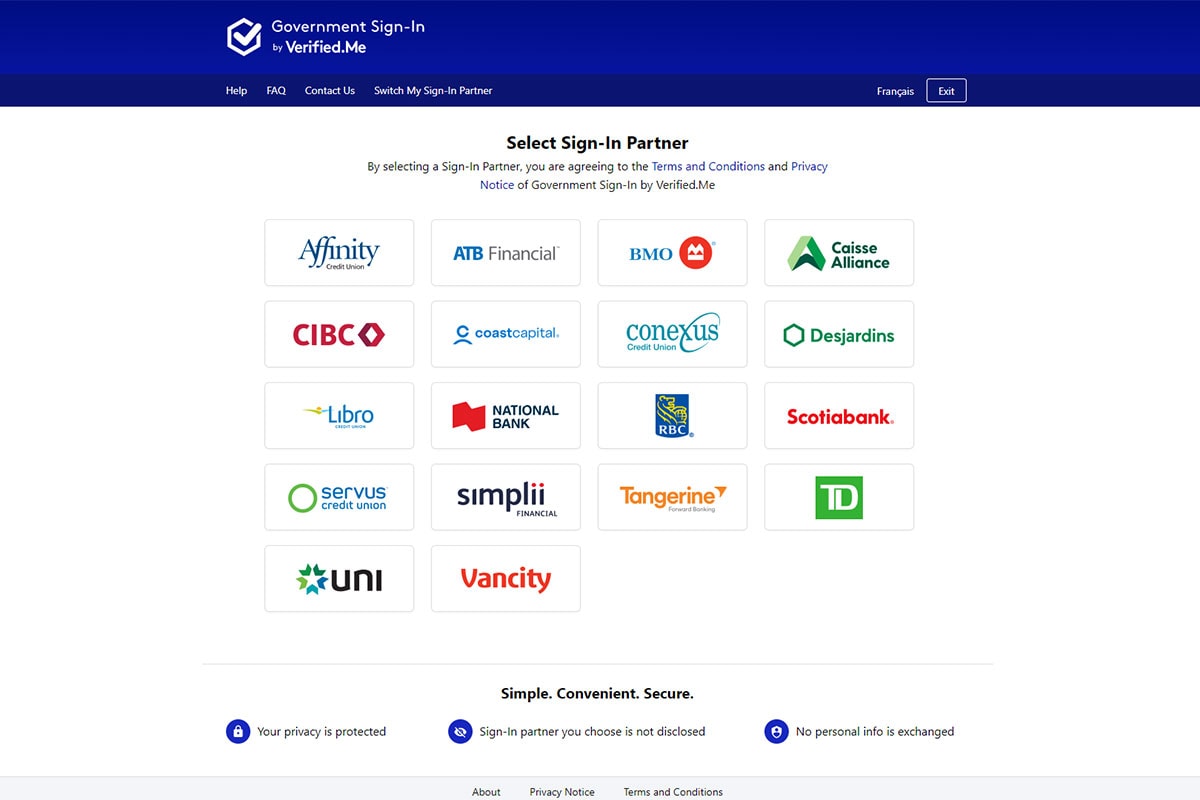

Option 2: Register with Your Bank

Another option is to register with your bank. To do this, you first have to find out whether your bank is a Sign-In Partner that’s verified. If it is, then you need to request an access code from them. This can be either a:

- PAC (Personal Access Code), or

- An AC (EI Access Code)

This access code will be provided to you through Service Canada. This will also take between 5 and 10 business days to arrive to you by mail. Once you have it, you can register for your MSCA account through your bank by using it.

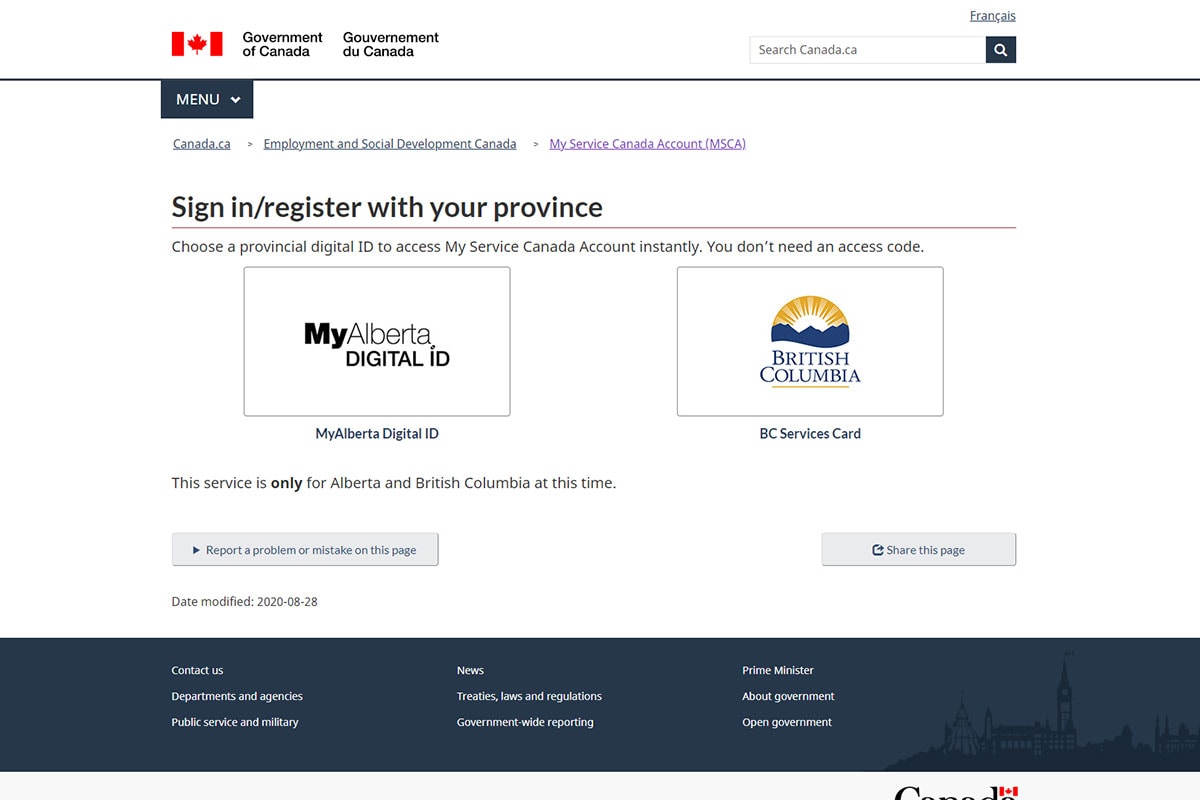

Option 3: Register Through Your Province

It’s also possible for you to register through your province, as long as your province is either Alberta or British Columbia. In this case, you won’t need an access code. All you need is your provincial digital ID to get access to your My Service Canada Account.

Step 3: Verify Identity and Set Up Your Account

- After logging in, you’ll be asked to confirm personal details such as your SIN and postal code.

- Then, you’ll set three security questions and answers for account recovery.

- You may be prompted to provide or confirm your email address or phone number.

- In some cases, a Personal Access Code (PAC) will be mailed to you for additional verification. This typically arrives within 5–10 business days.

Once you’ve completed these steps, you’ll have full access to your MSCA.

Existing Users: How to Login for a My Service Canada Account

Logging into MSCA is a quick process once you’re registered.

- Visit the official MSCA login page.

- Choose your sign-in method: GCKey, Sign-In Partner, or Provincial ID.

- Enter your credentials and security code (if two-factor authentication is enabled).

- Once authenticated, you’ll land on the dashboard with access to all benefits and services.

How to Update Your Information in MSCA

Keeping your information up to date ensures your benefits aren’t delayed or interrupted.

You Can Update:

- Mailing address

- Banking information for direct deposit

- Phone number and email

- Preferred language of communication

- Power of attorney or representative authorization

- Emergency contact details

Technical Troubleshooting and Best Practices

Troubleshooting Tips:

- Browser compatibility: Use updated Chrome, Firefox, Safari, or Edge.

- Clear cache and cookies if you experience login issues.

- Disable pop-up blockers for document downloads.

- Reset password or recover username via GCKey or bank partner if locked out.

Security Recommendations:

- Enable two-step verification where possible.

- Avoid public Wi-Fi when accessing your account.

- Never share your security questions or PAC.

There are several ways you can contact MCSA, depending on which program you want to get in touch with. These include Social Insurance Number, EI Contact Information, Canada Pension Plan, and Old Age Security. We’ll review each of these in detail now.

Social Insurance Number

You can get in touch regarding Social Insurance Number online, by phone, by mail, and in person. For a more in-depth read on applying for a SIN (if you don't already have one) be sure to also read our guide on the topic. We’ll review each of these now in detail. This way, you can find out which one is the best form of communication for you.

ONLINE

To get in touch online, you can use eServiceCanada. You will get contacted regarding your query at most 2 business days after.

BY PHONE

You can call toll-free at 1-866-274-6627. You can also call Canada TTY at 1-800-926-9105. If you’re outside of Canada, you can call long-distance at 1-506-548-7961. TTY outside of Canada you can call 1-800-926-9105.

BY MAIL

By mail, you can contact MSCA at the following address: Service Canada, Social Insurance Registration Office, PO Box 700, Bathurst, New Brunswick, E2A 4T1, Canada. You can apply or ask about your SIN record by mail.

IN PERSON

You can go in person to your local Service Canada office by searching based on your address or province. However, because of the current COVID-19 Pandemic, you are urged not to visit these offices at this time.

EI Contact Information

You can get in touch with EI Contact Information online, by phone, by mail, and in person. We’ll review each of these now in detail. This way, you can find out which one is the best form of communication for you.

ONLINE

To get in touch online, you can use eServiceCanada. You will get contacted regarding your query at most 2 business days after.

BY PHONE

You can call toll-free at 1-800-206-7218. You can also call Canada TTY at 1-800-529-3742.

BY MAIL

By mail, you can return reports or send supporting documents. The address you will send these reports and supporting documents vary depending on which province you’re based in, so you should visit the government website to learn more.

IN PERSON

You can go in person to your local Service Canada office by searching based on your address or province. However, because of the current COVID-19 Pandemic, you are urged not to visit these offices at this time.

Canada Pension Plan

You can get in touch with Canada Pension Plan online, by phone, by mail, and in person. We’ll review each of these now in detail. This way, you can find out which one is the best form of communication for you.

ONLINE

To get in touch online, you can use eServiceCanada. You will get contacted regarding your query at most 2 business days after.

BY PHONE

You can call toll-free from the US and Canada at 1-800-277-9914. You can also call from the US and Canada TTY at 1-800-255-4786. If you are outside of Canada or the US, then you can call collect at 1-613-957-1954.

BY MAIL

By mail, you can contact your closest Service Canada office. If you’re not in Canada, then you can contact a Service Canada office in the province in which you resided last.

IN PERSON

You can go in person to your local Service Canada office by searching based on your address or province. However, because of the current COVID-19 Pandemic, you are urged not to visit these offices at this time.

Old Age Security

You can get in touch with Old Age Security online, by phone, by mail, and in person. We’ll review each of these now in detail. This way, you can find out which one is the best form of communication for you.

ONLINE

To get in touch online, you can use eServiceCanada. You will get contacted regarding your query at most 2 business days after.

BY PHONE

You can call toll-free from the US and Canada at 1-800-277-9914. You can also call from the US and Canada TTY at 1-800-255-4786. If you are outside of Canada or the US, then you can call collect at 1-613-957-1954.

BY MAIL

By mail, you can contact your closest Service Canada office. If you’re not in Canada, then you can contact a Service Canada office in the province in which you resided last.

IN PERSON

You can go in person to your local Service Canada office by searching based on your address or province. However, because of the current COVID-19 Pandemic, you are urged not to visit these offices at this time.

Need More Information?

Now that you’ve learned about how to login, register, and complete other actions regarding your My Service Canada Account, maybe you need more information. Maybe you want to learn about other ways you can access benefits or financially plan for your future.

At Insurdinary, we can help. We’re a financial comparison platform that helps you plan for your life.

To learn more about how we can help you, contact Insurdinary now.