What Does Saskatchewan Health Plan Cover?

The Ministry of Health covers most medically necessary hospital and physician services (under the Saskatchewan Medical Care Insurance Act) as long as they’re provided in the publicly-funded healthcare system.

The following are the medical services that are fully covered through your Saskatchewan Health Card:

- Visits to a family doctor or physician and medical examinations

- Diagnostic procedures and laboratory services

- Occupational therapy and physiotherapy

- Mammogram screening for women between 50 and 69 years of age

- Mental health services

- Medically necessary dental surgery

- Home care services, including case assessment and home nursing

- Medical services through institutions that have a contract with the Saskatchewan Health Authority

- Problem gambling services and services for treating alcohol and drug abuse problems

- Influenza vaccine for all residents 6 months and older and immunizations for children

- AIDS testing and treatment of STIs

Medical services that are partially covered by your Saskatchewan Health Card include:

- Air ambulance (ordered by a medical practitioner)

- Ambulance for seniors (up to $275)

- Chiropodist and podiatry services

- Optometric services for residents who have eye trauma or diabetes and children aged 17 and under

The Saskatchewan Health Plan doesn’t cover:

- Routine dental services

- Air ambulance (unless necessary for urgent medical treatment)

- Prescription drugs

- Eyeglasses

- Medical examinations for employment or insurance

- Psychologist

- Ground ambulance (except for senior residents)

- Naturopaths, massage therapy, acupuncture, and other paramedical or complementary services

What does Saskatchewan Seniors Drug Program Cover?

Saskatchewan’s Senior Drug Program is for residents 65 years of age and older and it ensures that they pay $25 per prescription for drugs that are approved under Exception Drug Status or listed in the Saskatchewan Formulary.

The plan doesn’t include senior residents covered under the federal Non-Insured Health Benefits Program, Veterans Affairs Canada, or other federal government program.

What does Student Care Cover?

The Student Care plan covers various services that are not covered by the provincial healthcare plan. To be eligible to make health claims, you must have Canadian provincial healthcare or equivalent coverage.

The Saskatchewan Student Care covers the following services:

- Prescription drugs

- Hospitalization, home care, and tutorial service

- Health practitioner

- Accidents and emergencies

- Medical equipment

- Vision coverage

- Travel coverage

- Eligible medications

- Diagnostic services

- Vaccinations

- Dental coverage (partially covered)

Registering for Saskatchewan Provincial Health Plan

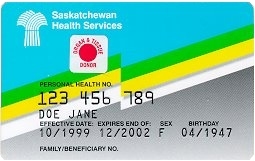

To be eligible for benefits, you must be registered with the Saskatchewan Ministry of Health. Once registered, Health Registries will issue a Health Card to you and each one of your family members once your applications have been approved.

If you are a newcomer to the Saskatchewan province, you’re required to register for the provincial health plan. Your health coverage begins on the first day of the third month following the date of your established Saskatchewan residence. In other words, if you establish residency on April 16, your coverage would begin on July 1.

The provincial Ministry of Health also covers health services for special classes of newcomers. As a newcomer from outside Canada, you may be eligible for health benefits from the day you arrive to Saskatchewan if you are a:

- permanent resident (landed immigrant)

- non-immigrant who is in Canada in connection with your profession or trade

- discharged member of the Canadian forces

- returning spouse of Canadian Forces member

- returning resident

- returning Canadian citizen

- international student

To register for a Health Card, you should get an application form available from the administrators of offices of Health Registries, rural municipalities, villages, and towns. You can also get the application form by visiting www.ehealthsask.ca/healthregistries.

Health Registries will require information about dependents or children remaining in another Canadian territory or province and intending to move to Saskatchewan upon completion of the current school year. If you are 18 years of age (or older) and single, you must register separately.